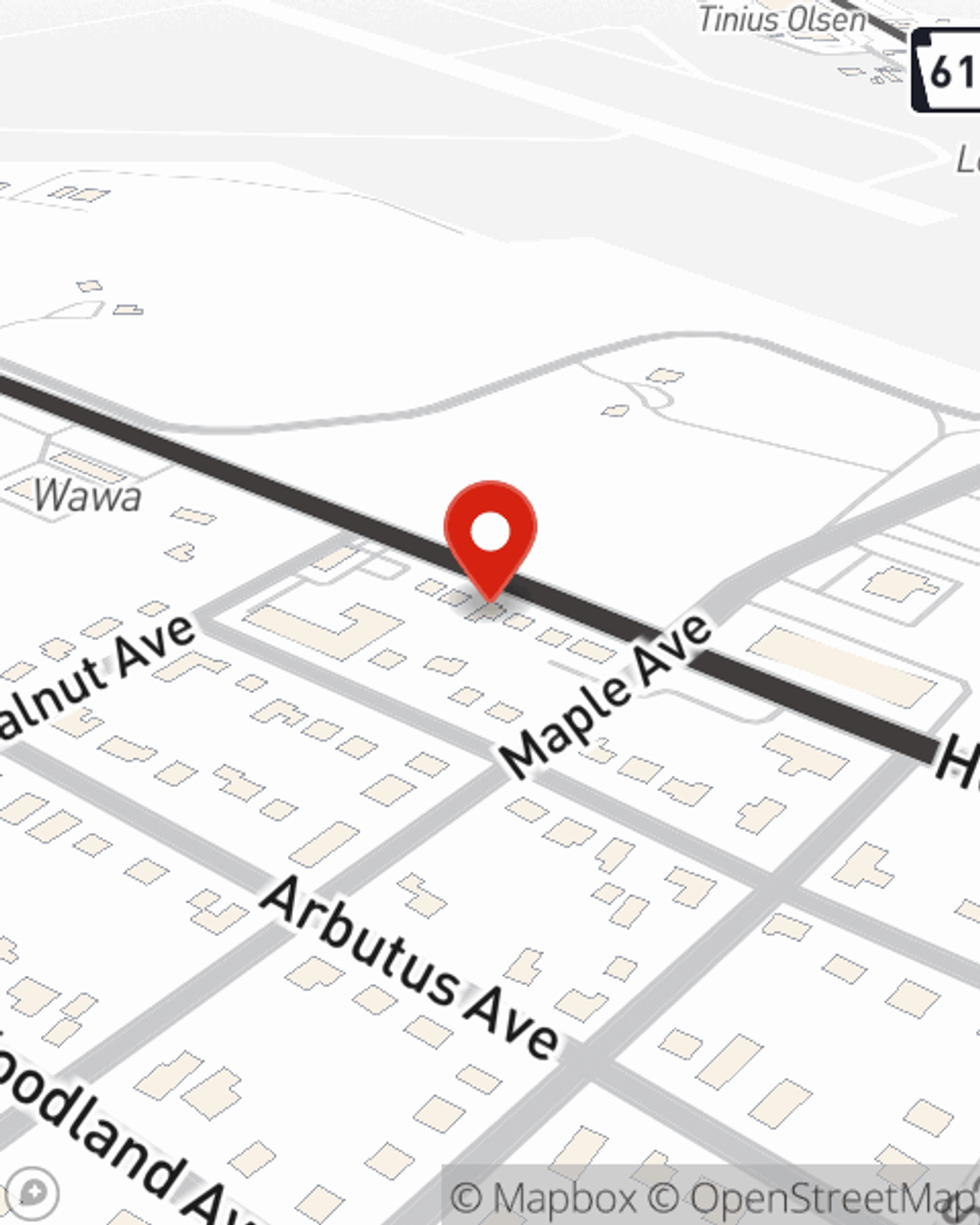

Business Insurance in and around Horsham

One of Horsham’s top choices for small business insurance.

Almost 100 years of helping small businesses

- MontCo, PA

- Horsham

- Maple Glen

- Hatboro

- Warminster

- Dresher

- Fort Washington

- Glenside

- Ambler

- North Wales

- Warrington

- Spring House

- Abington

- Jenkintown

- Montgomeryville

- Willow Grove

- Roslyn

- Chalfont

- Bucks County, PA

Help Prepare Your Business For The Unexpected.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Ashlee Biondo can relate to the work that it takes and would love to help lift some of the burden. This is coverage you'll definitely want to explore.

One of Horsham’s top choices for small business insurance.

Almost 100 years of helping small businesses

Protect Your Business With State Farm

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are an insurance agent or a tailoring service or you own a toy store or a pizza parlor. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Ashlee Biondo. Ashlee Biondo is the agent who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

It's time to get in touch with State Farm agent Ashlee Biondo. You'll quickly observe why State Farm is one of the leaders in small business insurance.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Ashlee Biondo

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.